Custom Design

Are you having trouble forecasting where your market is going but your competition appears to be a step ahead? Market trends analysis is not merely a matter of gathering information—it’s about taking that knowledge and turning it into strategic leverage that fuels actual business growth.

Knowing the market trends of the market and competitive dynamics can be the difference between prospering or just surviving. When you’re an expert at industry intelligence, you’re not only responding to change—but predicting it, taking your brand to the right position, and making opportunities while others are trying to catch up.

This exhaustive manual will guide you through the process of creating a strong market intelligence system, from spotting emerging trends to competitive analysis and instituting predictive forecasting and strategic response systems that set your business apart.

Market trends and competitive analysis is the disciplined process of collecting, analyzing, and interpreting data on your industry environment, competitor actions, and changing market circumstances. It is your business’s scanning radar system—always surveying the airwaves for signs that may affect your success.

This is more than mere data gathering. It’s about the ability to understand the forces driving your market, recognizing competitor patterns, and seeing opportunities before others do. Done properly, it forms the basis of good decision-making across all facets of your business.

The true power comes from applying these insights to actions. You won’t just know what is occurring but why it’s occurring and how it impacts your particular business situation. This information serves as your competitive foundation, guiding everything from product planning to marketing positioning.

The strategic need for market intelligence has never been more imperative. Companies that continuously watch and analyze market trends outperform those acting in the dark, and frequently by wide margins.

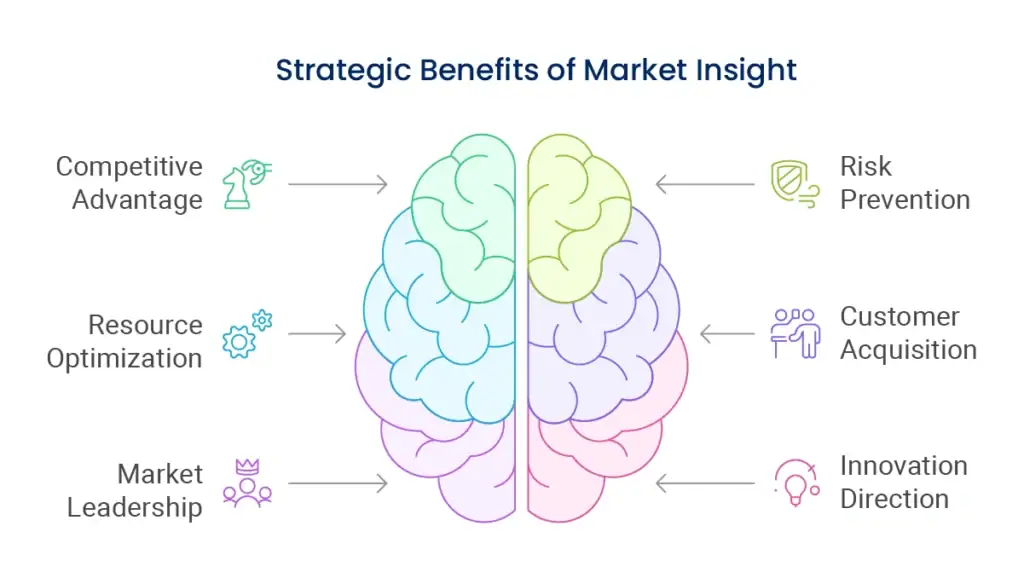

Here’s why having this skill under your belt redefines your business results:

You'll see chances and danger months ahead of everyone else, providing you with valuable lead time to respond and capitalize.

Early warning systems enable you to steer market disruption, economic change, and competitive attack before they harm your business.

Knowing market dynamics allows you to deploy resources where and when you need to, significantly enhancing return on investment.

Trend analysis directs innovation initiatives to ensure new products align with actual market demands, not hypotheses.

Consumer behavior studies indicate changing tastes, enabling you to refine your offerings and communication to keep pace.

Industry insight determines unstudied niches and positioning strategies that deliver market leadership.

The companies we deal with who have full-scale market intelligence systems usually experience 25-40% increases in the accuracy of strategic decisions and significantly accelerated response to market changes.

Your market intelligence architecture is the foundation for strategic decision-making. The system must be wide-ranging but targeted, gathering the correct information without drowning your team in data noise.

The architecture begins by establishing your intelligence needs. What exactly are those critical market indicators that most affect your business? Who are the greatest threats or opportunities among your competitors? What are the key consumer behaviors that most affect your success? Your answers drive your entire intelligence framework.

Think of creating various streams of intelligence for various reasons. Competitive intelligence is about tracking direct competitors’ activities, and trend intelligence is about observing wider market trends. Consumer intelligence is about monitoring behavioral changes, and technology intelligence is about recognizing new tools and platforms that might disrupt your sector.

Competitive intelligence is much more than monitoring what the competition places on social media. It entails regular monitoring of their strategic actions, new product introductions, price changes, marketing campaigns, and market positioning adjustments.

Begin by classifying your competition into primary, secondary, and upcoming threats. Primary competitors compete directly with your target customers. Secondary competitors provide different solutions to the same needs. Emerging competitors are new players or old players entering your sector.

Institute regular monitoring cadences instead of infrequent checks. Weekly competitive briefings, monthly trend reports, and quarterly deep dive analyses provide a consistent intelligence stream that informs continuous strategic planning.

The most effective competitive monitoring integrates automated tools with human analysis. Technology can monitor mentions, price changes, and content publishing, but human insight is needed to comprehend the strategic relevance of these activities.

Effective trend spotting involves seeing through cosmetic changes to grasp underlying patterns and drivers. This means tracking various sources of information and linking ostensibly disparate developments into logical trend stories.

Begin with your own direct industry publications and reports but branch out to related industries that could potentially portend future market trends in your sector. Technological trends tend to break in a single sector before percolating into others. Social and cultural revolutions also tend to follow a similar path.

Pattern detection becomes more natural with time and methodical recording. Maintain precise records of trends that you’ve monitored, such as when you first became aware of them, how they evolved, and their final effect. That hindsight enhances future pattern detection skills.

Search for convergence points where two or more trends intersect. Convergence points tend to be the most important opportunities or disruptions. For instance, the intersection of mobile technology, social media, and e-commerce gave birth to entirely new business models that transformed multiple sectors.

Predictive analysis transforms historical data and current market trends into actionable forecasts about future market conditions. This capability has become increasingly sophisticated with advances in analytics and machine learning technologies.

Start with basic trend extrapolation using historical performance data. Identify cyclical patterns, seasonal variations, and growth trajectories that can inform short-term forecasting. This foundation supports more advanced predictive modelling as your capabilities mature.

Consumer behavior analysis benefits significantly from predictive approaches. By analysing purchasing patterns, engagement metrics, and demographic shifts, you can anticipate changing preferences and adjust your strategies accordingly.

Machine learning applications excel at identifying complex patterns across large datasets. These systems can process multiple variables simultaneously, uncovering relationships that human analysis might miss. However, remember that algorithms require quality input data and human oversight to generate meaningful business insights.

Economic indicators often serve as leading indicators for specific industries. Understanding which broader economic trends impact your market helps you anticipate challenges and opportunities well in advance.

Having intelligence without effective response mechanisms wastes the entire investment. Strategic response frameworks help you translate insights into concrete actions that strengthen your competitive position.

Develop scenario planning capabilities that prepare responses for different potential futures. Rather than trying to predict exactly what will happen, prepare for multiple possibilities. This approach ensures you can respond quickly regardless of which scenario unfolds.

Position monitoring helps you understand how market changes affect your competitive standing. Track your brand perception relative to competitors, monitor share of voice in key conversations, and measure how effectively you’re capitalising on identified opportunities.

Response timing often determines success or failure. Some opportunities require immediate action, while others benefit from patient development. Your framework should include timing criteria that help prioritise different types of responses.

Integration with technology turns market intelligence into a highly advanced, automated system that provides real-time insights from a process that was once done manually. Creating a good information ecosystem needs strategic selection of tools and well-laid planning.

Your technology stack must consist of data gathering tools, analysis platforms, and reporting systems that integrate with each other seamlessly. Social media monitoring tools monitor brand mentions and competitive activity. Web scraping solutions collect price data and product data. Analysis platforms crunch this data into actionable insights.

API integrations enable various tools to exchange data without manual intervention, minimizing effort and ensuring accuracy. If your social monitoring platform is able to push data straight into your analytics dashboard, you have quicker insights at a lower effort level.

Cloud-based solutions provide scalability and reach that onsite systems simply can’t match. Your team is able to access intelligence updates remotely, and the system can expand with your business without the need for major infrastructure investments.

Consider the cost of ownership when choosing tools. Enterprise solutions provide sophisticated features but some companies find they get great results from well-chosen combinations of less expensive tools. The secret is making sure your solutions play nice together and fulfill your specific intelligence needs.

Market disruption challenges all aspects of your intelligence and response mechanisms. Whether responding to economic recessions, emerging competitive challenges, or technological disruption, your market intelligence system must enable you to act quickly and intelligently.

Early warning signs allow you to identify potential disruption when it is still incompletely formed. These can include anomalous competitor behavior, supply chain shifts, regulatory trends, or changes in consumer attitudes that foretell larger change on the horizon.

Crisis response plans should be established in advance instead of created during actual disruptions. When disruption hits, you require instant access to contextual intelligence, clear decision-making, and forethought response alternatives.

Communication gets paramount during disruptions. Your system of intelligence ought to enable fast dissemination of information throughout your organisation in a way that everyone is privy to the same real-time understanding of market conditions.

Recovery planning begins by understanding how disruptions alter the competitive environment. Some businesses come out stronger from disruptions by coping better than rivals. Knowledge capabilities can detect these opportunities even in worst times.

Ecosystem analysis within your industry shows the intricate web of relationships between various participants in your market, ranging from customers and suppliers to complements and regulators. By understanding these relationships, you can see opportunities that are not apparent when focusing only on direct competition.

Systematically map your ecosystem outward, beginning with immediate connections and moving outward. Add in suppliers, customers, distributors, complements offering different products or services, and even indirect actors such as regulators and industry associations.

Network effects frequently decide which firms end up ruling markets. Knowing how value moves through your ecosystem enables you to position your company to take advantage of these effects instead of being disrupted by them.

Collaboration opportunities are often uncovered through ecosystem analysis. Firms that appear like competitors in one scenario can be great partners in another. Mapping ecosystems brings these opportunities and allows you to assess potential collaboration gains.

Power relationships in ecosystems change over time. Track how control and influence flow from one player to another, and position your company to gain advantage from these changes instead of being put at a disadvantage by them.

Competitive advantage that is sustainable results from incorporating market intelligence into your operating and strategic planning processes deeply. Such integration ensures that intelligence findings inform decisions at all levels of your organisation.

Strategic planning cycles should include formal market intelligence reviews. Rather than treating intelligence as supporting information, make it central to strategic discussions. What do current market trends suggest about your market’s future? How are competitive dynamics shifting? What opportunities are emerging that require strategic response?

Operational integration ensures that intelligence inputs inform decisions on a day-to-day basis. Marketing departments must be allowed to access competitive intelligence while mapping out campaigns. Product departments must know about upcoming market trends while creating new products. Sales departments must know about competitive positioning when approaching prospects.

Measure performance against intelligence effectiveness indicators. Are you recognizing trends sooner than the competition? How well are your market projections forecasting real conditions? Are intelligence inputs resulting in improved strategic outcomes?

The best companies use market intelligence as a core competency and not as a supporting function. They commit to building internal expertise, have specific processes in place for collecting and analysing information, and build cultures that reward and respond to intelligence insights.

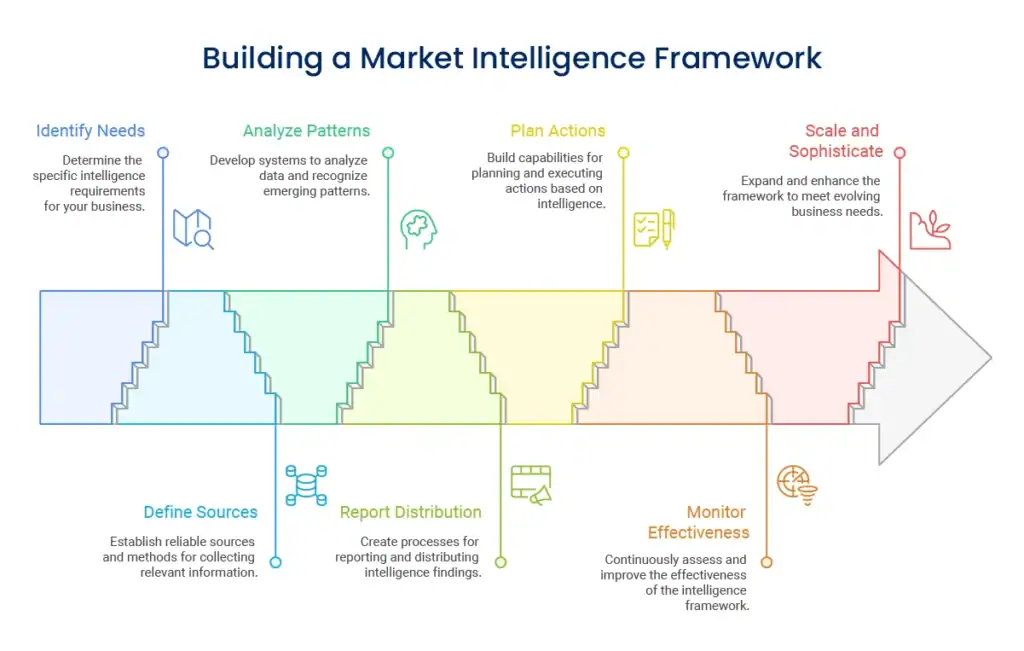

Establishing sound market intelligence capabilities must happen step by step across several domains. Begin with building a foundation before moving to advanced analysis and forecasting capabilities.

Start by determining what information your company really needs. Various companies need different forms of intelligence depending on their markets, competitive situations, and strategic goals. Don't fall into the trap of gathering everything—stay focused on decision-supporting intelligence.

Identify sound sources for the intelligence you require. These normally consist of industry journals, business rivals' sites, social media surveillance, customer comments, supplier information, as well as economic indicators. Define consistent collection routines instead of haphazard gathering activities.

Create capability to turn raw data into useful insights. This may entail spreadsheet analysis, bespoke software, or sophisticated analytics platforms based on your resources and requirements. The focus is on consistency and systematic examination and not ad hoc reviews.

Intelligence is useless if it does not make it into the hands of decision-makers in usable formats. Set up regular reporting cycles, develop standardized formats, and get insights to the right people at the right times. Weekly reports, monthly reviews, and quarterly deep-dive studies tend to work well.

Close the gap between intelligence and action by establishing well-defined processes for turning insight into strategic response. This involves scenario planning, response prioritization, and implementation tracking systems.

Measure how effectively your intelligence efforts are driving business outcomes. Are you spotting opportunities sooner? Making more informed strategic decisions? Preventing issues better? Use these findings to continually improve your approach.

The proper tools have the capability to vastly improve your market intelligence capabilities while keeping manual work to a minimum. Success, though, relies more on structured processes than costly software.

Social Media Monitoring Platforms: Platforms like Hootsuite Insights, Brandwatch, or Google Alerts can monitor competitor mentions, industry discussions, and trending topics. Begin with free products and scale up as your needs increase.

Industry Analysis Platforms: IBISWorld, Mintel, or specialized research providers provide professional-level market analysis and forecasting. These are normally heavily invested in but offer high-quality results.

Competitive Intelligence Tools: SEMrush, Ahrefs, or SimilarWeb platforms expose competitor digital planning, traffic sources, and online performance metrics. These allow you to see competitive positioning and spot opportunities.

Customer Survey and Feedback Systems: Internal customer intelligence tends to be more valuable than third-party research. Software such as SurveyMonkey, Typeform, or customer feedback software enables you to see evolving preferences and satisfaction levels.

Analytics and Reporting Platforms: Google Analytics, Tableau, or alternative platforms enable you to crunch intelligence data and generate persuasive reports for decision-makers. Visual representation tends to make insights more actionable.

Keep in mind that tools aid processes—they never substitute strategic thinking or methodical examination. Begin with less complicated, less expensive tools and go higher end as your abilities and needs improve.

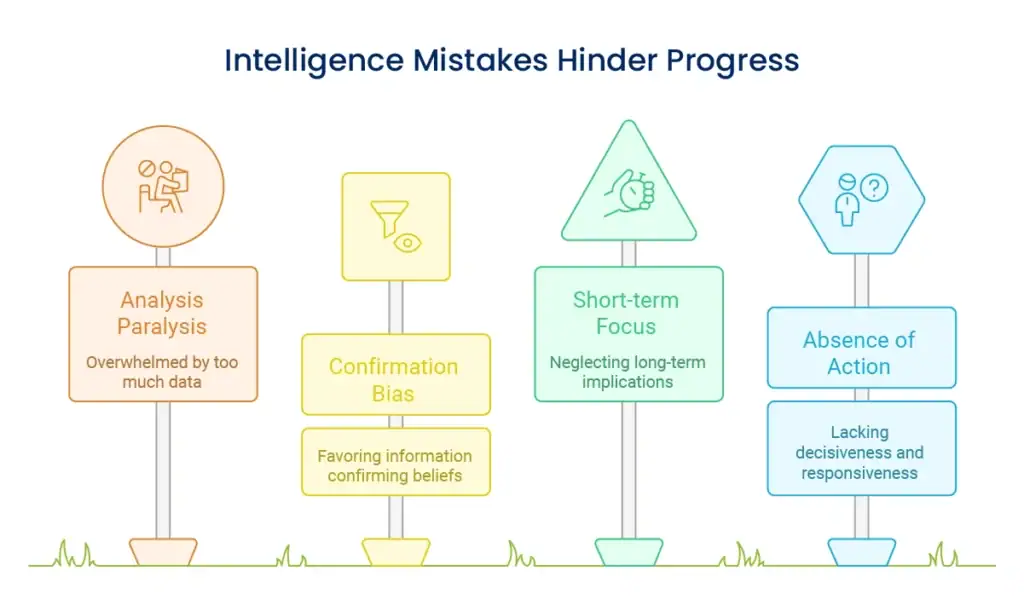

Too much collection of information without defined purpose or analysis frameworks is one of the most prevalent errors. This results in floods of data that never actually result in actionable insights.

Prevent it by defining clear intelligence requirements prior to starting the collection process. What are the specific questions you are attempting to answer? What decisions will be informed by this intelligence? How will you determine if the intelligence is valuable?

Focus on quality over quantity. Better to have deep, actionable insights in a few key areas than superficial coverage across many areas. Your intelligence efforts should support specific business objectives rather than satisfying general curiosity.

Human nature leads us to seek information that confirms our existing beliefs while ignoring contradictory evidence. This tendency can make market intelligence worse than useless by reinforcing poor strategic assumptions.

Fight confirmation bias by explicitly looking for disconfirming data. What are you being told that indicates your premises could be incorrect? What else can explain the patterns you are seeing? How could you be interpreting the data incorrectly?

Institute devil’s advocate procedures in your analysis. Get other team members specifically to seek out weaknesses in your conclusions or alternative explanations of the same data. This dialectic helps dramatically enhance analysis quality.

Most companies concentrate too much on short-term oscillations and overlook long-term trend evolution. This creates reactive plans that pursue transient movements instead of positioning for durable gain.

Balance short-term tracking with long-term trend-watching. Weekly and monthly check-ups would highlight near-term issues and opportunities, while quarterly and annual review considers strategic ramifications and longer-term positioning.

Differentiate between transient fluctuations, nascent trends, and deep-seated shifts. Not all change heralds a long-term trend, and not all market trends necessitate strategic reaction. Establish benchmark criteria for assessing the magnitude and duration of changes noted.

Action without intelligence is random and wasteful. Numerous organizations are good at collecting and analyzing data but poor at converting learning into useful strategic responses.

Develop response capacity in parallel with intelligence capacity. What are you really going to do with various kinds of insights? How fast can you make changes on the basis of intelligence discoveries? What capabilities exist for strategic response?

Create transparent processes for transitioning from insight to action. These involve decision-making powers, mechanisms for analyzing and distributing resources, and systems to track implementation. Intelligence must be fed directly into strategic planning and operational decision-making.

Most companies realize their initial gains within 60-90 days of having systematic market intelligence processes in place. Early gains usually involve enhanced competitive insight, enhanced trend identification, and wiser decision-making.

But the greatest advantages—such as being able to accurately forecast market changes or know great opportunities—usually take 6-12 months to develop as your pattern recognition ability improves and your information sources increase.

The secret is beginning with targeted, manageable initiatives and gradually increasing sophistication instead of attempting to deploy full-scale systems at once.

Investment in intelligence should proportionally increase with business size and market complexity. Excellent results are typically achieved by most small to medium enterprises by investing 2-5% of revenue in intelligence activities, such as tools, people time, and external research.

This investment usually consists of monitoring tools (₹50,000-₹200,000 per year), analysis time (0.5-1.0 FTE equivalent based on business size), and occasional external research or consultant support.

Return on investment in intelligence is usually more than 300-500% due to better decision-making, quicker opportunity identification, and risk avoidance. Start small and grow investment as you prove value.

Successful competitive intelligence depends on publicly available data and ethical methods of collection. Concentrate on data that your competitors are making public through their marketing, public disclosures, press releases, and industry involvement.

Steer clear of any action that could be interpreted as industrial espionage, such as trying to gain access to confidential data, misrepresenting yourself to gain information, or any other dubious tactics.

Most highly valuable competitive intelligence is derived from careful analysis of publicly available information that anyone might find. The benefit lies in steady monitoring and better analysis, not secretive collection.

Advanced analytics does bring great value, but small businesses must focus on systematic processes before advanced tools. Most great insights arise from diligent examination of simple information compared to intricate modelling.

Begin with simple market trends analysis, competitive tracking, and gathering customer feedback. As your performance and abilities prove worth, introduce progressively advanced analysis techniques and tools.

Most crucial is systematic and consistent application over technical complexity. An uncomplicated system applied consistently tends to perform better than complicated systems applied intermittently.

Creating in-house market intelligence capabilities achieves long-term competitive advantage with lower long-term costs. Instead of depending solely on outside vendors, build team members familiar with your unique market environment and your business requirements.

Begin by assigning particular responsibility for intelligence work. This could be a part of someone’s current role at first, but ultimately turn into a formal responsibility with dedicated time and resources. They become your intelligence champion and coordinator.

Offer training in analysis techniques, industry research methods, and strategic thinking. A lot of online courses, industry seminars, and professional development programs can develop these skills over time.

Cross-functional integration of intelligence guarantees insights get to all decision-makers who need them. Marketing departments gain from competitive intelligence, product departments gain from trend analysis, and sales departments gain from market opportunity insights. Develop processes that share applicable intelligence across functions.

Establish intelligence sharing mechanisms that encourage collaboration and not hoarding information. Routine briefings, shared databases, and cross-functional analysis sessions ensure maximum intelligence value across your organisation.

Measure intelligence effectiveness using several measures instead of using a single measure. Quality measures could be prediction accuracy, timing of trend identification, and effectiveness of decision support.

Business outcome measures bridge the gap between intelligence activities and actual outcomes. Are you recognizing opportunities sooner? Committing fewer strategic errors? Enhancing competitive advantage? These results validate intelligence investments and inform improvement initiatives.

Response time measures are gauging how rapidly you execute intelligence into action. Early warning value is lost if your response to threats or opportunities discovered is slow. Monitor and attempt to enhance your response capacity.

Cost-effectiveness analysis verifies your investment in intelligence yields fitting returns. Compare intelligence expenditure with opportunity values discovered, risk avoided, and enhanced decision results. Cost-effectiveness analysis will inform resource provision and investment decisions.

Routine capability reviews help you find areas of improvement and investment. What kinds of intelligence do you need but lack? Where are your analysis skills weakest? How can you enhance information quality and coverage?

Long-term success is achieved by embedding market intelligence deeply in your organisation’s DNA, not as an optional activity. This embedding develops sustainable competitive advantages that gain strength over time.

Strategic planning procedures ought to incorporate intelligence outputs and trend analysis formally. Instead of formulating strategies in vacuum, base them on comprehensive knowledge of market forces and competitive conditions. This yields more realistic and operational strategic plans.

Innovation direction allows you to create products and services in alignment with actual market demands and not internal suppositions. Strategic development is more effective when informed by strong market intelligence and trend analysis.

Competitive intelligence and awareness of market trends are particularly beneficial to market positioning. Knowing how competitors are positioning, what appeals to customers, and how market preferences are evolving allows for more effective brand positioning strategies.

Risk management is greatly enhanced through systematic monitoring of the markets. Early warning systems enable you to anticipate potential risks before they fully materialize, and you can use that time to design and execute protective measures.

Technology advances market intelligence capabilities further while lowering cost and complexity. Artificial intelligence, machine learning, and automation increasingly enable intelligence gathering and analysis processes.

Natural language processing software is able to process huge amounts of text-based data, such as social media content, news stories, and business reports. Such abilities aid in trend and sentiment change detection that could otherwise go unnoticed.

Predictive analytics platforms utilize past data to predict future market conditions with greater and greater accuracy. Although these programs need to be implemented carefully and under human observation, they can deliver significant insights into probable future events.

Integration features grow stronger, enabling various intelligence tools to collaborate better. APIs and data-sharing standards facilitate easier development of end-to-end intelligence ecosystems that offer integrated market perspectives.

Cloud and mobile technologies provide access to intelligence anywhere, anytime. Decision-makers have immediate access to real-time intelligence wherever they are, allowing for quicker response times and more dynamic strategic thinking.

Still, keep in mind that technology aids human judgment and not to replace it. Even the most advanced analysis tools need human judgment to understand results and convert them into practical business strategies.

Mastering market intelligence is not done overnight, but it all starts with your initial systematic action in getting to know your competitive environment and marketplace dynamics. The companies that hold these capabilities constantly outperform the companies that rely on experience or responsive methods.

Success is a result of beginning with focus and adding sophistication over time. Start with well-defined intelligence needs, sound sources of information, and orderly analysis procedures. As your skills become more mature, add more sophisticated tools, greater analysis techniques, and wider coverage areas.

The competitive edge gained through market intelligence grows exponentially over the long run. Every trend you detect early, every opportunity you detect before the competition, and every risk you sidestep contributes to cumulative successes in building defensible strategic differentiators.

Your investment in market intelligence skills reaps rewards throughout all areas of your enterprise, from strategic planning and product development to marketing positioning and risk management. The insights you create form the basis for assured, informed decision-making that fuels actual business growth.

Creating market intelligence capabilities of world-class quality demands expertise, process discipline, and consistent effort. If you’re willing to achieve the competitive advantage that stems from deep market insight, our people at Brand Wisdom Solutions can assist you in creating and deploying intelligence systems that bring tangible business results.

We excel at assisting companies to develop long-term competitive strengths by strategic brand management and complete market intelligence frameworks. Our method unites leading edge tools with established methodology in order to produce intelligence capabilities that expand with your company.

Get in touch with us to learn how dominant market intelligence can move your business forward and solidify your competitive position in an ever-evolving marketplace.

Enter your email to get instant access