Custom Design

Imagine this: You’re seated in a boardroom, and eyes are turned to you for the next great strategic decision. Your competitors always appear to be ahead of the game, rolling out products that connect so well with customers you’ve assumed you know so well. Does this sound familiar?

This is the situation played out daily in thousands of companies. Without market analysis, you’re literally flying blind in a rapidly changing competitive environment. The key to success for brands that make it and those that just get by lies in one thing: their capacity to gather, interpret, and respond to market intelligence.

Market analysis is not merely about gathering facts—it’s about taking unrefined facts and turning them into strategic leverage. Done correctly, it is your competitive intelligence hub, enabling you to see opportunities ahead of rivals, know your customers better than they know themselves, and make decisions with assurance instead of guesswork.

This in-depth guide will take you through all that you have to master market analysis, from constructing your intelligence architecture to applying cutting-edge analytical techniques that lead to actual business outcomes.

Market analysis is the systematic procedure of collecting, analyzing, and interpreting data on your market situation, customers, competitors, and industry trends in order to make intelligent business decisions.

Think of it as your business radar system. As pilots use radar to guide them safely through complicated airspace, savvy business managers apply market analysis to guide them through competitive markets, spot opportunities, and steer clear of would-be threats.

At its essence, market analysis marries quantitative data with qualitative understanding to give you a full picture of your business environment. We’re not just referring to comprehending what’s occurring in your market, but the why, the who and the where.

The strategic basis of sound market analysis is built on three pillars: extensive data gathering, strict analysis, and actionable intelligence. When combined, these elements form a strong decision-making model that can change everything from product development to marketing strategy.

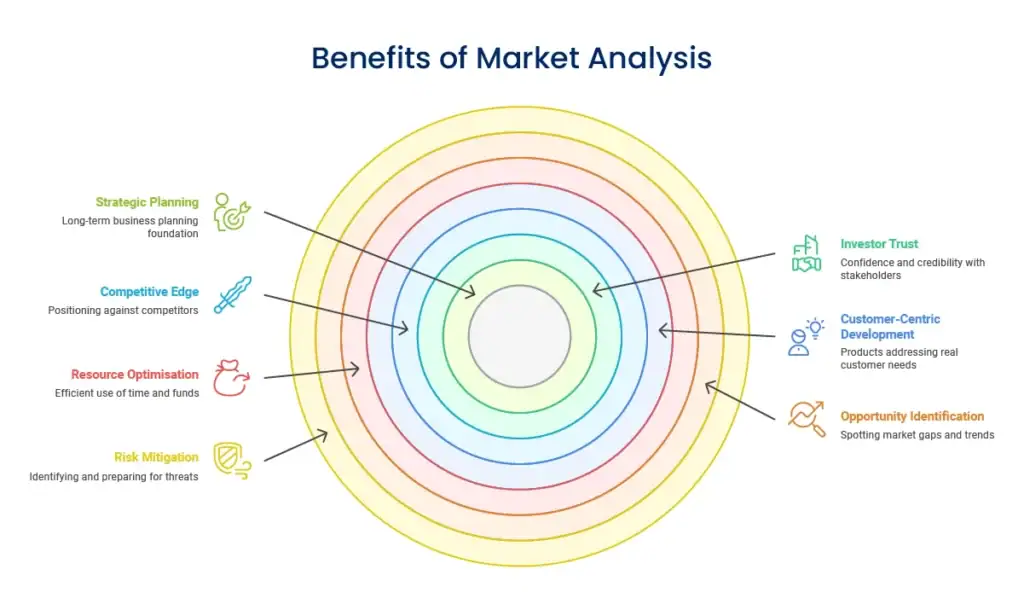

Market analysis is the cornerstone of strategic decision-making and has a direct influence on your ability to compete, expand, and respond to changing circumstances.The following is why becoming a master of market analysis is essential to your success:

Accurate analysis enables you to discover potential threats and market directions prior to their effects on your bottom line, enabling you to shift or prepare accordingly.

Having insight into gaps in the market, growing trends, and unsatisfied customer needs, you can identify opportunities that others may overlook.

When you precisely know where your market is going, you are able to invest your time, funds, and energy better, wasting no money on expensive errors.

Profound insights into the market guarantee that your products and services really do resolve genuine issues for genuine people, not abstract ones.

Knowing your competitors' strengths, weaknesses, and strategies enables you to position your brand better and spot areas where you can beat them.

Sound market analysis shows stakeholders that your business decisions are not guesswork but evidence-based, instilling confidence and credibility.

Market analysis is especially useful for startups and small companies since you’re up against well-established competitors who have more resources. Clever analysis enables you to carve out your niche, learn about your target customers, and compete strategically instead of trying to outspend your bigger competitors.

Creating a successful market analysis begins with the development of a solid intelligence architecture that facilitates constant data gathering and analysis.

Your intelligence architecture must contain structured processes for collecting information from various sources, arranging that information to be easily accessible and analyzed, and updating your market image regularly as conditions evolve. This is not about developing sophisticated systems—it’s about setting up solid workflows that enable you to always work with up-to-date, applicable information.

The finest intelligence systems intertwine technical data gathering tools with human understanding and interpretation. Technology may assist you in tracking measures, monitoring competitors, and collecting customer feedback, but human analysis is what converts raw data into strategic advantage.

The quality of your market analysis depends entirely on the quality of your data collection. Excellence in research means knowing where to look, what to look for, and how to verify the information you gather.

Primary research entails gathering information directly from your target market via surveys, interviews, focus groups, and direct observation. You have information that no one else does, but it takes more time and money to do correctly.

Secondary research utilizes already available data from industry reports, government databases, scholarly studies, and published research. It’s quicker and cheaper than primary research, but you’re using the same data your competition has.

The best way is to integrate both kinds of research, leveraging secondary sources to get an understanding of the greater market environment and primary research to gain particular insights regarding your particular position within that environment.

After you’ve gathered your data, the work really begins. Advanced analytical methodologies assist you in looking for patterns, trends, and insights that may not be right away apparent.

Statistical analysis methods can reveal relationships between various market variables, forecast future patterns based on past data, and segment your market according to significant attributes. You don’t have to be a statistician to apply these techniques—advanced analysis is made available to business professionals through many tools.

Qualitative analysis techniques allow you to see the why behind the numbers. Customer interviews, competitor analysis, and observing trends give context that unadulterated data analysis may not pick up.

Scenario planning and sensitivity analysis enable you to appreciate how shifts in significant market variables could influence your business, enabling you to plan for various potential futures.

Getting to know your customers has more to do with beyond-the-basics demographics. Customer intelligence is about creating deep knowledge of customer behaviour, motivations, preferences, and decision-making patterns.

Good market segmentation breaks down your larger market into smaller clusters with common characteristics, requirements, or behaviour. That enables you to adapt to each segment, maximising effectiveness and efficiency.

Behavioral segmentation examines the way customers engage with products and services, whereas psychographic segmentation is concerned with values, attitudes, and lifestyle. Geographic and demographic segmentation are useful to have in context but must not be your sole focus.

Customer journey mapping enables you to see how various segments progress through the purchase process, and where you can impact decisions as well as where customers may fall out of the funnel.

Competitor research is more than merely knowing who your rivals are. Real competitive intelligence is about comprehending their plans, their strengths and weaknesses, and their probable future actions.

Direct competitors sell comparable products or services to similar customers. Indirect competitors may fix the same customer issue in a different manner. Substitute competitors provide substitute solutions that customers may opt for as an alternative to your category altogether.

Analysis of market dynamics looks at the drivers of change in your business: technological advances, changes in laws and regulations, economic issues, and changing customer tastes. You can respond to change instead of reacting to it by knowing these dynamics.

Porter’s Five Forces model continues to be one of the most helpful competitive dynamics tools: threat of new entrants, supplier bargaining power, buyer bargaining power, threat of substitute products, and competitive rivalry within the industry.

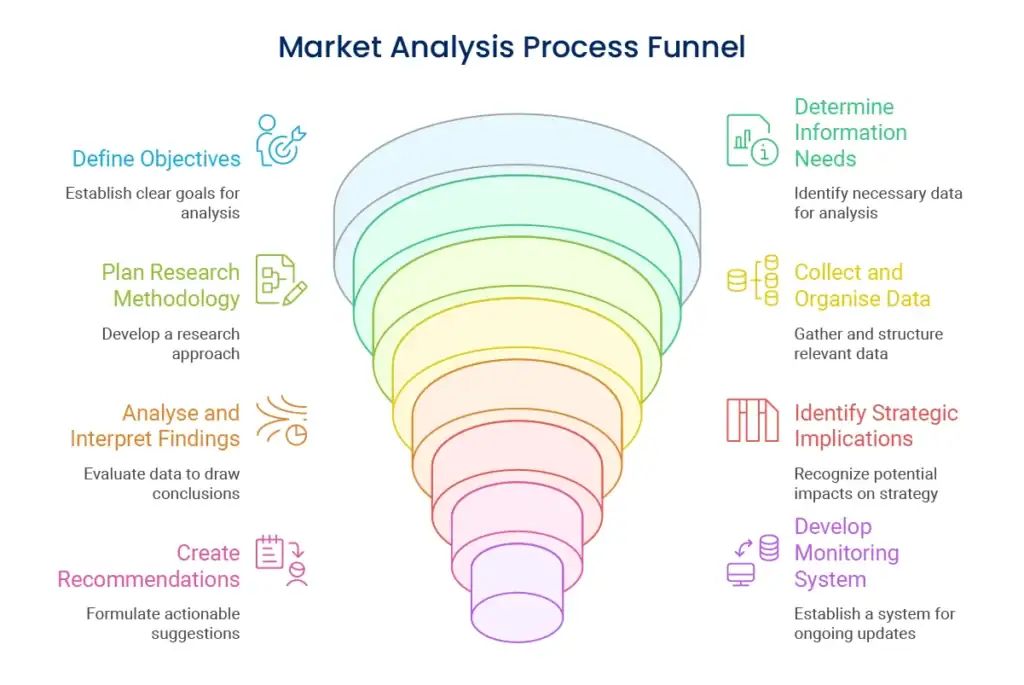

Begin by setting out clearly what you need to discover from your market analysis. Are you assessing a new product opportunity? Attempting to discover why sales have fallen? Designing market entry? Varying objectives call for varying approaches.

List specific questions your analysis should provide answers to. Rather than “get a better understanding of the market,” attempt “determine the three largest areas of growth in our market during the next 18 months” or “get an understanding of why costs to acquire customers have risen by 40% this year.”

Your goals must be connected to larger business objectives and decision-making requirements. If you’re not going to do something with the insights you’re collecting, don’t take the time to collect them.

Depending on your goals, decide specifically what information you must gather. It could be market size and growth rates, customer demographics and behavior, competitor strategy and performance, regulatory framework, or technology trends.

Develop a research schedule that gives priority to the most important information first. You can always accumulate more data later on, but you want to make sure you have the basics well covered.

Use both quantitative information (numbers, statistics, measurable trends) and qualitative understanding (opinions, motivations, explanations). Best analyses use both sources.

Select the research approaches that will best collect the information you require within your budget and time constraints.

For primary research, look to online surveys for large-scale quantitative data, in-depth interviews for deep qualitative information, focus groups for group discussions and dynamics, or observational research for real behaviour patterns.

For secondary research, look to industry reports, government databases, academic research, trade publications, and competitor information sources that can offer informative insights.

Plan your sample sizes and selection criteria deliberately. A small but carefully selected sample is often more valuable than a large but ill-chosen one.

Carry out your research plan in a methodical way, making thorough records of all sources of information and collection methods. This record will be important if you need to check findings or revise your analysis in the future.

Develop a centralized system for structuring your information that allows you to quickly locate specific information. This could be a basic spreadsheet, a specialized database, or research market software.

As you gather facts, begin searching for patterns and relationships. Early pattern detection can direct your future research and enable you to identify areas where you require more information.

Start your analysis by searching for obvious trends and patterns within your quantitative data. What’s increasing? What’s on the decline? What’s holding steady? Search for correlations between variables that may indicate causal connections.

Apply your qualitative observations to explain and contextualize the patterns you observe within your quantitative data. Numbers inform you of what’s occurring; qualitative research will help you know why it’s occurring.

Consider multiple interpretations of your findings. What alternative explanations could account for the patterns you’re seeing? This critical thinking helps you avoid jumping to conclusions based on incomplete or misleading information.

Translate your analysis results into concrete implications for your business plan. How do industry trends influence your opportunity to grow? What do your competitors’ moves imply for your competitive edge? How should customer learning affect product or service design?

Rank implications by potential impact on your company and degree of confidence in supporting data. Prioritize first those insights with high impact and strong evidence.

Take into account both short-term tactical effects as well as longer-term strategic issues. Some may recommend immediate changes to ongoing activities, while others may have significant strategic implications.

Turn your strategic implications into clear, actionable recommendations. Each one should be clear, concise, and related to your initial analysis goals.

Add implementation considerations to each recommendation: resources required, timeframe, possible barriers, and success indicators. This factual data allows decision-makers to consider and respond to your recommendations.

Provide alternative courses of action where relevant. Virtually never is there just one right solution; illustrating different possibilities with their respective advantages and disadvantages indicates careful examination.

Market conditions are continually shifting, so your analysis must be revised regularly in order to continue being relevant. Create monitoring systems for tracking key market indicators and revising your analysis as new data arrives. Determine leading indicators that could provide warning of significant changes before they most clearly express themselves within your market. Early warning systems keep you ahead of trends instead of reacting after they have begun.

Plan routine analysis review meetings to keep your market knowledge up to date. Quarterly is fine for most companies, but rapidly changing markets may need monthly analysis updates.

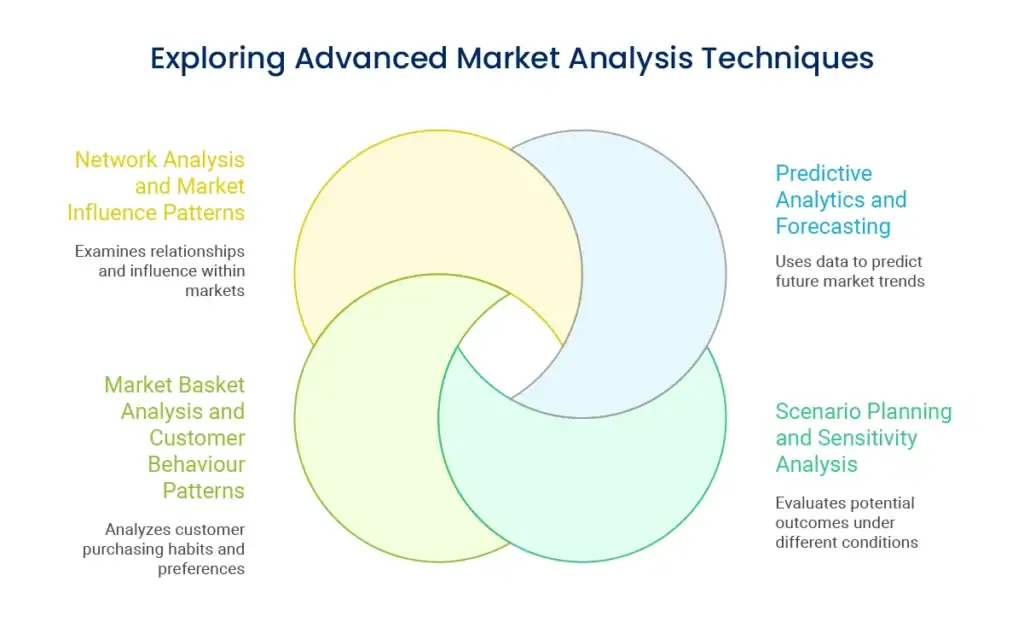

Today’s market analysis is becoming more dependent on predictive analytics to forecast future market situations instead of merely describing existing ones. Such methods apply past data patterns to predict what may come in the future and guide companies to prepare for probable outcomes.

Time series analysis analyzes how important market variables vary with time, recognizing seasonal trends, long-term tendencies, and cyclical patterns. This method proves to be especially effective for demand forecasting, price trends, and market growth rates.

Regression analysis allows you to find out relationships between various market variables and how changes in one variable can influence others. For instance, you may find that demand for your product category changes in line with changes in disposable income.

Machine learning software has the ability to recognize intricate patterns in large sets of data that may be beyond the ability of traditional methods. While more technically demanding, these systems can reveal rich information in data-rich markets.

Market basket analysis looks at what products or services customers buy together, and identifies cross-selling opportunities and customer behaviour patterns.

This method extends beyond mere correlation to see how and when customers buy complementary products. When do customers add complementary products? How does a first purchase affect later buying behavior?

Customer lifetime value analysis takes market basket data and customer retention information and applies them together in order to determine your most profitable customer segments and the drivers of long-term customer value.

Cohort analysis monitors customer behavior over time, so that you can see how customer relationships develop and which acquisition channels generate the most profitable long-term customers.

Today’s markets are increasingly networked, with influence spreading through webs of customers, partners, suppliers, and other groups. Network analysis assists you in charting these relationships and seeing how influence propagates throughout your market.

Find key influencers within your market: customers whose views have special value, industry leaders whose advice sparks adoption, or distribution partners who can break or make product success.

Learn how information moves through your market networks. Social media analysis, referral pattern tracking, and influence mapping enable you to understand the best ways to reach and influence your target customers.

Partnership network analysis looks at the interconnections between various firms within your market environment, allowing you to spot potential collaboration alliances and competitive competition.

The market analysis in the contemporary era is greatly helped by technology tools that can analyze big data at high speeds and detect patterns that may escape human analysis.

Customer relationship management (CRM) tools offer thorough customer behaviour, preference, and interaction patterns insights. Contemporary CRM implementation solutions integrate with various business systems to offer in-depth customer intelligence.

Business intelligence tools bring data together from various sources and offer combined dashboards making it simple to track essential market metrics and notice trends as they emerge.

Social monitoring tools monitor brand, competitor, and customer sentiment across social channels and give real-time views of market attitudes and new trends.

Survey and feedback platforms facilitate cost-effective primary research with automated analysis capabilities to uncover major themes and trends in customer feedback.

Good market analysis is not only about capturing insights—it’s about presenting those insights in a way that inspires action. Data visualisation turns difficult analysis into easy-to-understand, hard-to-ignore presentations, helping stakeholders grasp and take action on your findings.

Interactive dashboards let users drill down into the details behind high-level trends, examining data from various angles to gain valuable insights.

Visual summaries and infographics break down tough market analysis so busy executives can quickly grasp main points.

Systematic reporting tools can produce timely market updates automatically, keeping important stakeholders informed of developments without needing to prepare reports manually.

The most worthwhile market analysis seamlessly integrates into your current business systems, transferring insights directly into decision-making operations.

Market analysis information can be utilized by marketing automation platforms to personalize customer messaging, target campaigns more effectively, and enhance conversion rates.

Customer insight integration enhances product development systems so that new products and new features solve actual market needs as opposed to supposed requirements.

Sales management systems with market intelligence allow sales forces to better understand the needs of the customer and position solutions better.

Financial planning and forecasting systems with market analysis offer more precise forecasts and improved strategic investment decision support.

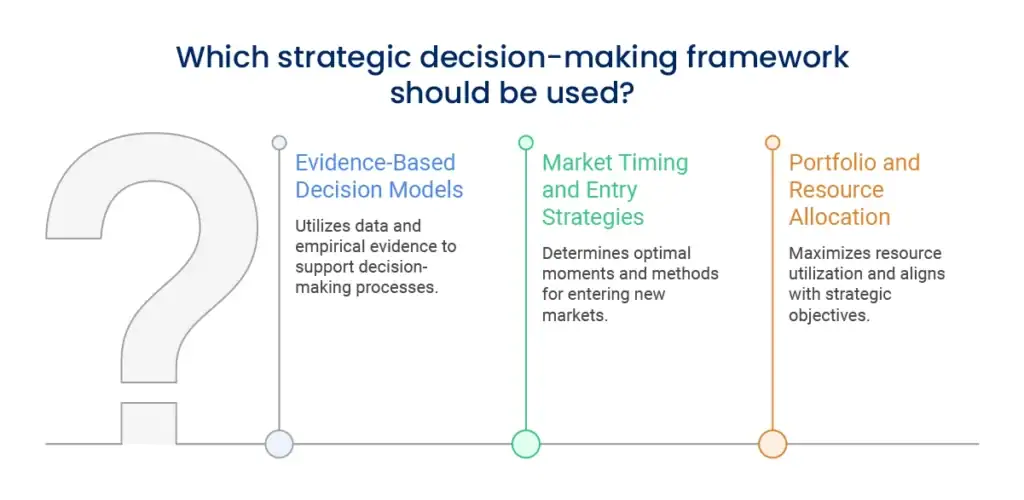

Turn your market analysis into improved business decisions by embracing systematic decision-making structures that guarantee you taking all the applicable considerations into account.

The decision tree method plots out various possible options and likely outcomes, allowing you to analyze options in terms of probability-weighted consequences instead of optimal assumptions.

Cost-benefit analysis puts numbers on the anticipated value of alternative courses of action, taking both the costs involved and the potential rewards into account. Both direct financial effects and more elusive strategic rewards should be included.

Risk assessment systems enable you to see not only the anticipated results of alternative choices, but also the extent of possible outcomes and the likelihood of alternative scenarios.

Multi-criteria decision analysis enables you to balance various factors—financial returns, strategic fit, levels of risk, resource consumption—when evaluating sophisticated strategic alternatives.

Knowledge about market timing may be as critical as knowledge about market opportunity. Your analysis must enable you to decide not only whether to enter a market, but when to enter in order to best take advantage.

Market maturity analysis looks at where your target market is at in its lifecycle: emerging markets have the high growth potential but also high risk, mature markets have stability but low growth possibilities.

Competitive landscape timing takes into consideration when to expect major moves from competitors and thus allows you to time your own efforts for maximum effect and minimal competitive reaction.

Customer readiness testing examines whether your potential customers are prepared to embrace your solution, in terms of awareness levels, budgets available, and competing demands.

Regulatory and economic timing considerations can heavily influence the success of market entry, especially in highly regulated markets or in times of economic volatility.

Your market analysis should inform how you spread resources among various markets, customer groups, and strategic projects.

Portfolio matrix strategies, such as the Boston Consulting Group growth-share matrix, assist in classifying various market opportunities on a growth-potential and competitive-position basis, directing investment strategies.

Resource constraint analysis ensures your market expansion strategy is feasible with your available resources to avoid overstretch that may dilute execution quality.

Synergy analysis considers how various market initiatives can support one another, looking for opportunities to share resources, cross-sell, or complement each other’s positioning.

Return on investment estimates for various market opportunities allow you to rank projects based on anticipated financial return adjusted for risk and resource needs.

Establishing solid market analysis capabilities in your organization generates sustainable competitive advantage by enhancing the quality of all your strategic decisions over the long term.

Strategic brand management derives great benefit from continuous market intelligence, enabling you to modify your brand positioning and messaging as market conditions shift.

Team development allows several individuals in your organisation to be able to contribute to market analysis work, lessening reliance on personal expertise and enhancing the scope of insights you are able to capture.

Process documentation and knowledge management systems retain analysis insights and methods so that you can leverage earlier work instead of repeating similar work every time there is new analysis.

Extended partnering with research agencies, industry bodies, and other knowledge sources can leverage your analytical capacity above what can be achieved with in-house resources alone.

To be truly effective, market analysis needs to incorporate analytical thought into your organisation’s culture and decision-making processes.

Leadership commitment to evidence-based decision-making sends a message to the whole organisation to encourage teams to collect and review market intelligence before making significant decisions.

Training and skill-building enable team members at all levels to make contributions towards market intelligence gathering and analysis, increasing your analytical capability.

Communication channels ensure that market insights are delivered to the right stakeholders at the right time, facilitating informed decision-making across business functions.

Performance metrics and rewards for market-informed decision-making motivate teams to spend time and effort in gathering and applying market intelligence.

The market analysis profession is constantly developing, with emerging technologies and methodologies providing more capabilities for gathering and interpreting market intelligence.

Applications of artificial intelligence and machine learning are increasingly available to small and medium-sized businesses, providing advanced analytical capabilities not previously available to all but the largest corporations.

Real-time data capture and analytical capabilities allow companies to react more rapidly to changing markets, and potentially derive competitive edge from enhanced market responsiveness.

Blockchain and other distributed technologies can potentially create new possibilities for market data capture and authentication, and enhance the reliability and richness of market intelligence.

Virtual and augmented reality technologies provide new means for customer research and market experimentation, potentially allowing richer customer behaviour and preference insights.

Markets themselves are changing in ways that demand new analytical methods and frameworks.

Digital disruption of industries generates new sources of data and customer interaction points, demanding greater analytical capabilities to capture and interpret these streams of information.

More market volatility and uncertainty render more conventional forecasting techniques increasingly suspect, demanding more advanced scenario planning and adaptive analytical techniques.

Globalisation and market interconnectedness imply that local market analysis increasingly has to take account of international considerations and cross-border influences.

Sustainability and social responsibility issues are also gaining increasing significance in market analysis since customers increasingly take these into account in their buying decisions.

Uniform brand presentation creates recognition and trust that directly equate to business worth. Uniform brand presentation companies usually enjoy higher customer loyalty, improved referral rates, and premium pricing opportunities.

Your brand style guide safeguards this investment by making every interaction align with your desired brand perception. Through time, this consistency accrets brand equity that is an important business asset.

Track the business effects of enhanced brand consistency through measures such as customer recognition rates, trust levels, and improvement in conversions. The data serves to justify the ongoing investment in brand management and inform future brand choices.

Think about how your brand rules aid your overall brand strategy development and business goals. Successful brand management is business-driven as opposed to being an isolated creative endeavor.

Probably the most common error in market analysis is taking data at face value without regard to quality, source, or limitations.

Sample bias results when your data sources are not representative of your larger market, producing conclusions which do not hold for your real customer base. Always assess whether your data sources represent the market segments you are attempting to know.

Correlation and causation confusion results in false assumptions regarding cause-and-effect relationships in your industry. Two variables don’t automatically cause one another simply because they move in the same direction.

Recency bias overemphasizes recent occurrences or data points, possibly ignoring longer-term patterns or cyclical behaviors more pertinent to strategic planning.

Confirmation bias makes experts prefer information that confirms existing views over contradictory evidence. Fight against this by actively searching for disconfirming evidence and thinking about alternative explanations for your results.

Good analysis will not produce value if it is not well applied to strategic decision-making.

Analysis paralysis happens when organisations spend more time retrieving and evaluating data so that they pass up opportunities or never implement insights in a timely fashion.

Over-generalisation takes findings from one market segment or scenario and applies them to situations where they might not fit, thus creating ineffective strategies.

Ignoring implementation limitations creates recommendations that appear great on paper but are not feasible based on organisational resources, capabilities, or market conditions.

Short-term orientation focuses on immediate opportunities without considering longer-term trends that could be of more strategic importance.

Knowledge about competitors is vital, but some familiar pitfalls can defeat the purposes of competitive analysis.

Fixation on Competitors places so much focus on existing competitors that new threats or alternative solutions are neglected.

Static analysis of competitors regards competitor positions as static when it should be understood that competitors too are changing their strategies based on market intelligence.

Public information bias is overdependent on what is made public about competitors while neglecting critical strategic knowledge that is not made public.

Overestimation of competitor capabilities results in strategic plans that predict competitors will not react effectively to your actions.

The frequency of complete market analysis is determined by your industry’s rate of change, level of competition, and strategic planning cycle. Most companies are well served by annual comprehensive analysis with quarterly reviews emphasizing key indicators and noteworthy trends.

Smaller, rapidly changing industries such as technology or fashion might need to be reviewed more often, whereas steady industries might only need thorough review every 18-24 months. The most important thing is to find an overall rhythm that keeps your market intelligence up to date without bogging down your staff with analysis work.

Track leading indicators on an ongoing basis so you can recognize meaningful shifts as they emerge instead of waiting for planned analysis windows.

Effective market analysis is more about methodology and focus than budget size. Small businesses can conduct valuable analysis with budgets of ₹25,000-₹75,000 annually by focusing on essential information sources and leveraging free or low-cost research tools.

Primary research tends to be more expensive than secondary research, so balance your approach on a cost-cutting basis. Online surveys, social monitoring, and competitor watching can yield valuable insights at relatively little expense.

Partner with other small companies to split research costs for studies across your industry, or hire business schools whose students could do research projects that are of interest to your market.

Validation needs to be an integral part of your process of analysis from the onset instead of as an added step.

Utilize multiple sources of information to validate significant findings. If three different sources of data indicate the same trend, you can be more certain of that observation than if only one confirms it.

Test key findings with small-scale market tests where feasible. Pilot programs, select product introductions, or focused marketing campaigns can test analytical conclusions against actual market outcomes.

Enlist outside experts or advisers to examine your analysis method and findings. Independent insight can recognize blind spots or question assumptions you may not challenge within.

Monitor how accurate your forecasts are over time to determine systematic biases in your analytical method and increase future analysis quality.

Mastering market analysis revolutionizes the way you make every significant business decision. Rather than trusting intuition or emulating competition, you acquire the ability to deeply know your market, predict shifts, and see opportunities others do not.

The companies that succeed in the long run are those that embed market intelligence into their culture. They do not only undertake analysis to drive key strategic decisions—rather, they are always acquiring, interpreting, and responding to insights about markets at all levels within their organisation.

Your path to mastery of market analysis begins with a commitment to evidence-based decision making and establishing the systems and capabilities to drive continuous market intelligence. The structures, methods, and tools we’ve discussed provide the foundations, but the true value lies in persistent use and continuous refinement.

The value you get for investing in developing market analysis skills repays you across all aspects of your business: improved products that customers really want, more successful marketing that speaks to genuine needs, competitive tactics based on real market forces instead of guesswork, and strategic plans based on market reality instead of hope.

Performance monitoring and analytics and reporting features can assist you in monitoring the success of your market analysis and maintaining ongoing market intelligence systems improvement.

Building full-cycle market analysis capability needs time, resources, and expertise that most emerging businesses cannot self-sustain. If you’re willing to heighten your market intelligence capacity but require expert advice on methodology, tool choice, or execution, we’re here for you.

Our specialists have extensive experience in assisting companies such as yours develop market analysis capabilities that create tangible strategic edge. From research design to analytical framework implementation and teaching your staff the best practices, we offer the knowledge you require to turn market intelligence into a strategic advantage.

Reach out to us for how we can assist your path to market analysis mastery and ensure that you make more educated, assertive strategic choices.

Enter your email to get instant access